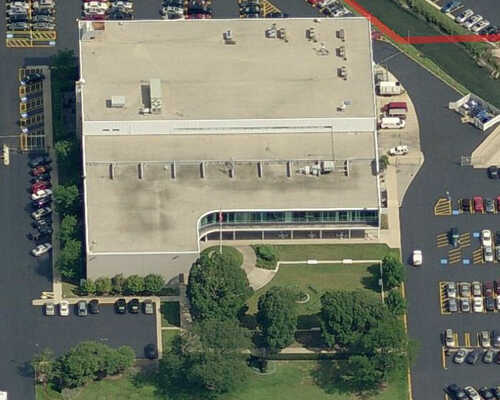

Single-Story Flex Industrial

Willowbrook, Illinois

Opportunity

Part of a portfolio purchase from the Royal Bank of Scotland (RBS), this 96,000 sf industrial building was fraught with structural challenges, deferred maintenance and significant vacancy. The property had an additional 7 acres of undeveloped land and the potential to increase the storm water detention in the existing footprint of the pond to accommodate future development. The local sub market was very active with prospective tenants.

Result

Purchased for less than $2.7M, a comprehensive redevelopment plan was executed. The entire property was repaired, refurbished and repositioned in the market. The property was 100% leased within 24 months. Prior to offering the property for sale, ownership subdivided the property to isolate the vacant land for future development. The building sold to a 1031 exchange buyer for $10.5M and the vacant parcel was later sold for $600,000. Return on outside equity was 29% IRR.